Embarking on a journey towards financial clarity can feel daunting, but with the right tools, it becomes an empowering experience. As we look ahead to the summer months, specifically June 2026, it’s the perfect time to establish a solid financial foundation. This is where a dedicated June 2026 Budget Planner Template comes into play, offering a structured path to understanding and managing your money effectively.

Many of us have financial aspirations, whether it’s saving for a dream vacation, paying down debt, or simply gaining a better handle on our daily spending. A budget planner isn’t just about restricting yourself; it’s about making conscious choices that align with your long-term goals. Let’s dive into how you can transform your financial outlook starting with the upcoming month.

The Power of a Monthly Budget: Why June 2026 Matters

A monthly budget serves as your financial roadmap, guiding your spending and saving decisions. Focusing on a specific month like June 2026 allows for precise planning, taking into account seasonal expenses or income shifts.

Understanding Your Financial Landscape

Before you can steer your finances, you need to know where you stand. This involves a clear-eyed assessment of your income and all your outflows. Many people are surprised to discover where their money truly goes each month.

A comprehensive budget template helps illuminate these patterns. It makes the invisible financial currents visible. This initial understanding is the most critical step in taking control.

Setting Realistic Goals for June 2026

With your financial snapshot in hand, you can define achievable goals for June. Perhaps it’s reducing dining out expenses, or increasing your emergency fund contribution. Specific, measurable, achievable, relevant, and time-bound (SMART) goals are key.

Avoid overly ambitious targets that might lead to frustration. Start small and build momentum. Celebrating minor victories helps maintain motivation throughout the month.

The Psychology of Saving and Spending

Budgeting isn’t just about numbers; it’s deeply psychological. Understanding your habits and triggers can be incredibly powerful. Are you an impulse buyer, or do you carefully consider purchases?

Recognizing these patterns allows you to implement strategies to curb unwanted spending. Building positive financial habits takes time and consistent effort. Your budget planner can be a tool for self-discovery.

Key Components of an Effective Budget Planner

Regardless of its format, every good budget planner shares core elements. These components ensure you capture all necessary financial data. Missing even one piece can throw off your entire plan.

Income Tracking: Knowing What Comes In

The first step in any budget is accurately recording all your income sources. This includes your primary salary, freelance earnings, or any other money you expect to receive. Don’t forget any anticipated bonuses or commissions for June.

A clear picture of your total income is fundamental. It forms the baseline for all your subsequent financial decisions. Be diligent in capturing every incoming dollar.

Fixed vs. Variable Income

Distinguish between fixed income (like a regular salary) and variable income (like sales commissions or gig work). Budgeting with variable income requires a bit more flexibility and often a more conservative approach.

If your income fluctuates, consider budgeting based on your lowest expected earnings. Any extra then becomes a bonus for savings or debt repayment. This strategy provides a safety net.

Expense Categorization: Where Does Your Money Go?

This is often the most revealing part of budgeting. Categorizing your expenses helps you identify spending patterns and areas for potential cuts. Common categories include housing, transportation, food, utilities, and entertainment.

Be specific with your categories to gain meaningful insights. Vague categories like ‘Miscellaneous’ can hide important details. The more granular, the better your understanding will be.

Fixed vs. Variable Expenses

Fixed expenses remain consistent each month, such as rent/mortgage, loan payments, and insurance premiums. Variable expenses fluctuate, like groceries, dining out, and entertainment. Understanding this difference is crucial for effective budgeting.

You have more control over variable expenses. This is where you’ll typically find opportunities for significant savings. Fixed expenses, while harder to change monthly, can be reviewed annually for better deals.

Needs vs. Wants

A powerful exercise is to label each expense as a ‘need’ or a ‘want.’ Needs are essential for living (e.g., housing, basic food, utilities). Wants are discretionary items that improve your quality of life but aren’t strictly necessary (e.g., cable TV, designer clothes, daily lattes).

This distinction helps in prioritizing spending, especially when money is tight. It empowers you to make conscious trade-offs aligned with your financial goals. Being honest with yourself here is key.

Debt Management and Savings Goals

Integrating debt repayment and savings directly into your budget is non-negotiable. Don’t wait until the end of the month to see what’s left over. Make these categories a priority from the start.

Treat your savings and debt payments like any other fixed expense. This approach ensures consistent progress towards your financial freedom. It shifts your mindset from reactive to proactive financial management.

Prioritizing Debt

If you have multiple debts, decide on a strategy: the debt snowball (paying smallest balance first) or the debt avalanche (paying highest interest rate first). Both methods are effective, choose the one that motivates you most.

Allocate a specific amount each month to debt repayment beyond the minimum payments. This accelerates your journey out of debt. Every extra dollar makes a difference over time.

Building an Emergency Fund

An emergency fund is your financial safety net, typically covering 3-6 months of living expenses. This fund protects you from unexpected job loss, medical emergencies, or large home repairs. Start small if you need to, but start.

Even saving $25 or $50 consistently each month adds up over time. It provides immense peace of mind. A robust emergency fund is a cornerstone of financial stability.

Long-term Savings

Beyond emergencies, consider your long-term goals: retirement, a down payment on a house, or your children’s education. Set up automated transfers to these accounts. Automation is your best friend in building wealth.

These contributions should also be a non-negotiable part of your budget. Your future self will thank you for planning today. Consistent contributions, even small ones, yield significant results.

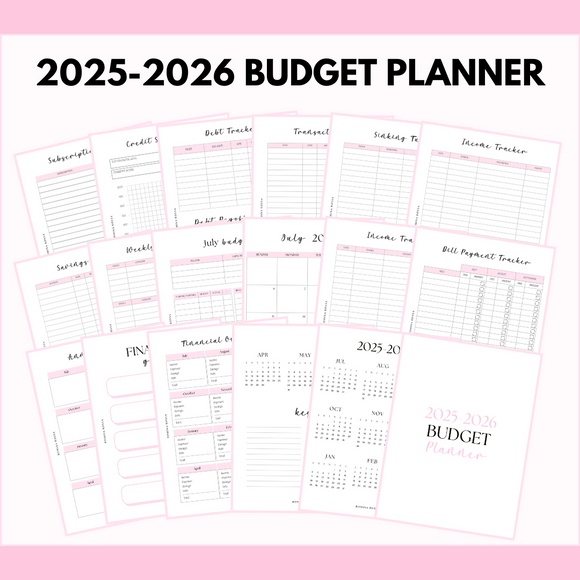

Choosing and Customizing Your June 2026 Budget Planner Template

The market offers a plethora of budget planner templates, from simple printables to sophisticated digital spreadsheets. The best template is one you’ll actually use consistently. Don’t overcomplicate it from the start.

Digital vs. Printable Options

Digital templates, often in Excel or Google Sheets, offer automation for calculations and easy editing. They are ideal for those comfortable with spreadsheets and looking for detailed tracking. Many even come with built-in charts and graphs.

Printable PDF templates are great for visual learners or those who prefer writing things down. They offer a tangible, less screen-dependent budgeting experience. Choose based on your personal preference and tech comfort level.

Excel/Google Sheets templates

These templates are highly customizable and can automate many of the calculations needed for budgeting. You can easily adjust categories, add formulas, and track progress over time. Many free versions are available online from trusted sources.

Their dynamic nature allows for real-time updates and financial forecasting. This can be incredibly powerful for advanced users. Explore templates specifically designed for monthly budgeting.

PDF printables

For those who love the feel of pen and paper, printable PDF budget templates are perfect. They provide a clear structure to fill in manually. This hands-on approach can sometimes reinforce budgeting habits more effectively for certain individuals.

You can keep a physical binder of your monthly budgets. This creates a tangible record of your financial journey. Simplicity is often their greatest strength.

Essential Features to Look For

When selecting a template, look for clear sections for income, fixed expenses, variable expenses, debt payments, and savings goals. A summary section that shows your net income after all deductions is also incredibly useful. Dashboards for visual progress are a bonus.

Ensure it’s easy to understand and navigate. Overly complex templates can be discouraging. User-friendliness is paramount for long-term adherence.

Personalizing Your Template for Success

Don’t be afraid to adjust a template to fit your unique financial situation. Add specific categories relevant to your lifestyle or remove those that don’t apply. Make it truly yours.

This personalization increases the likelihood of consistent use. A tailored tool is always more effective than a generic one. Your budget should reflect your life, not someone else’s.

Step-by-Step Guide to Using Your June 2026 Budget Planner

Now that you’ve chosen your June 2026 Budget Planner Template, let’s walk through the practical steps of filling it out and using it effectively. Consistency is the key to success in budgeting. Treat this process like a monthly financial health check-up.

Step 1: Gather Your Financial Information

Collect all necessary documents: pay stubs, bank statements, credit card statements, and bills. This ensures you have accurate figures for income and expenses. Dedicate a specific time to this task.

Having everything in one place streamlines the entire process. Avoid estimating if precise numbers are available. Accuracy provides a truer picture.

Step 2: Input Your Income for June

Record every source of income you expect to receive in June 2026. Be as precise as possible. If you have variable income, use a conservative estimate.

Sum up your total expected income for the month. This number will dictate your spending capacity. It’s the starting point for all your allocations.

Step 3: Log Your Fixed Expenses

Enter all your fixed monthly expenses into the template. These are the predictable costs that don’t change much from month to month. Rent, car payments, and subscriptions fall into this category.

These are easy to input because they’re consistent. Ensure you haven’t forgotten any recurring payments. Set reminders for upcoming bills if needed.

Step 4: Estimate Your Variable Expenses

This step requires a bit more thought and honesty. Estimate how much you plan to spend in categories like groceries, dining out, entertainment, and personal care. Look back at past months’ spending for a realistic benchmark.

It’s better to overestimate slightly than underestimate significantly. Give yourself a buffer. This helps prevent going over budget in flexible areas.

| Budget Category | Typical Allocation Range (%) | Example for $4000 Income (Monthly) |

|---|---|---|

| Housing (Rent/Mortgage) | 25-35% | $1000 – $1400 |

| Transportation | 10-15% | $400 – $600 |

| Food (Groceries & Dining Out) | 10-20% | $400 – $800 |

| Utilities | 5-10% | $200 – $400 |

| Debt Repayment (Non-mortgage) | 5-10% | $200 – $400 |

| Savings & Investments | 10-20% | $400 – $800 |

| Personal Care & Entertainment | 5-15% | $200 – $600 |

| Miscellaneous/Buffer | 5% | $200 |

Step 5: Allocate Funds for Savings and Debt Repayment

This is where you prioritize your future. Dedicate specific amounts to your emergency fund, long-term savings goals, and any debts you’re actively paying down. Make these allocations before other discretionary spending.

Automating these transfers on payday is highly recommended. It removes the temptation to spend the money elsewhere. Your future self will thank you for this discipline.

Step 6: Track Your Spending Daily

This is the most critical and often overlooked step. Throughout June, diligently record every dollar you spend. Use your template, a budgeting app, or a simple notebook.

Review your bank and credit card statements regularly. This prevents overspending and helps you stay accountable. Consistent tracking provides real-time insights into your financial health.

Step 7: Review and Adjust Mid-Month

Don’t wait until the end of the month to check your progress. A mid-month review allows you to make necessary adjustments. Are you overspending in a particular category?

This check-in provides an opportunity to reallocate funds or make conscious decisions to cut back. Flexibility is a hallmark of successful budgeting. It’s a living document, not set in stone.

Beyond June: Making Budgeting a Long-Term Habit

While a June 2026 budget is a great start, the real power comes from making budgeting a continuous habit. It’s not a one-time event but an ongoing process of learning and adapting. Think of it as a muscle you strengthen over time.

Regular Reviews and Adjustments

At the end of each month, compare your planned budget with your actual spending. What went well? Where did you overspend? Use these insights to refine your next month’s budget. This continuous feedback loop is invaluable.

Your financial situation and goals will evolve, and your budget should too. Be prepared to make significant adjustments as life changes. A flexible approach ensures long-term success.

Automating Your Savings

One of the easiest ways to ensure you meet your savings goals is to automate them. Set up automatic transfers from your checking account to your savings or investment accounts on payday. This ensures you pay yourself first.

Out of sight, out of mind works wonders for savings. You’ll be amazed at how quickly your balances grow without conscious effort. It’s a powerful financial hack.

Dealing with Unexpected Expenses

Life is full of surprises, and not always pleasant ones. Your emergency fund is specifically for these moments. If you have to dip into it, prioritize replenishing it as soon as possible. Avoid using credit cards for emergencies if you can.

Having a buffer helps you navigate unforeseen costs without derailing your entire financial plan. It reduces stress and financial anxiety. Planning for the unexpected is a sign of financial maturity.

Celebrating Your Financial Wins

Don’t forget to acknowledge your progress! Whether it’s sticking to your grocery budget for the month or making an extra debt payment, celebrate these achievements. Positive reinforcement keeps you motivated.

This doesn’t mean splurging excessively. Perhaps a small, guilt-free treat or an acknowledgment of your hard work. Financial discipline deserves recognition and encouragement.

Common Budgeting Mistakes to Avoid

Even with the best intentions, it’s easy to fall into common budgeting traps. Being aware of these pitfalls can help you steer clear of them and maintain your financial momentum. Learning from others’ mistakes can save you valuable time and effort.

Ignoring Small Expenses

Those daily coffees, subscriptions you barely use, or small impulse buys can add up quickly. These are often called ‘latte factors.’ They might seem insignificant individually but can seriously impact your budget over a month.

Be mindful of these recurring small expenses. A small cut in these areas can free up significant funds for savings or debt. Every dollar truly counts in the long run.

Being Unrealistic

Setting an overly strict budget that doesn’t allow for any fun or flexibility is a recipe for failure. If your budget feels suffocating, you’re more likely to abandon it. Be honest about your spending habits and needs.

Build in some wiggle room for discretionary spending. A sustainable budget is one that you can realistically stick to without feeling deprived. Find a balance that works for your lifestyle.

Giving Up Too Soon

Budgeting takes practice and patience. You might not get it perfect in June 2026, and that’s absolutely okay. There will be months where you overspend or face unexpected challenges. The key is to learn from it and start fresh the next month.

Don’t let a bad month derail your entire financial journey. Persistence is far more important than perfection. Keep showing up, keep tracking, and keep adjusting.

Embracing a proactive approach to your finances can bring immense peace of mind and significantly accelerate your progress towards your goals. A June 2026 Budget Planner Template is an excellent starting point for anyone looking to gain control over their money and build a more secure financial future. Start today, and watch your financial awareness and wealth grow.

Frequently Asked Questions

What is the primary benefit of using a specific monthly budget planner like the June 2026 template?

Using a specific monthly budget planner, such as the June 2026 template, allows for precise financial planning tailored to that particular month’s income, expenses, and unique seasonal events. It provides a clear, actionable snapshot, helping individuals track progress and make real-time adjustments efficiently, rather than relying on generic annual plans.

How do I choose between a digital (Excel/Google Sheets) and a printable (PDF) budget template?

The choice between digital and printable templates depends on your personal preference and lifestyle. Digital templates offer automation for calculations, easy editing, and dynamic tracking, ideal for those comfortable with spreadsheets. Printable PDFs are great for tactile learners who prefer writing things down, providing a tangible record and a potentially less screen-dependent budgeting experience. The best one is the one you will use consistently.

What are the most crucial categories to include in my budget planner?

Every effective budget planner should include clear sections for income, fixed expenses (e.g., rent, loans), variable expenses (e.g., groceries, entertainment), dedicated allocations for debt repayment, and savings goals. A summary section showing your net income and actual vs. planned spending is also incredibly useful for reviewing your financial health.

What common mistakes should I avoid when using a budget planner?

Key mistakes to avoid include ignoring small, recurring expenses that add up significantly, setting unrealistic budget limits that lead to frustration, and giving up too soon after a challenging month. It’s important to be honest with your spending, allow for some flexibility, and remember that budgeting is a continuous learning process, not a one-time perfect execution.