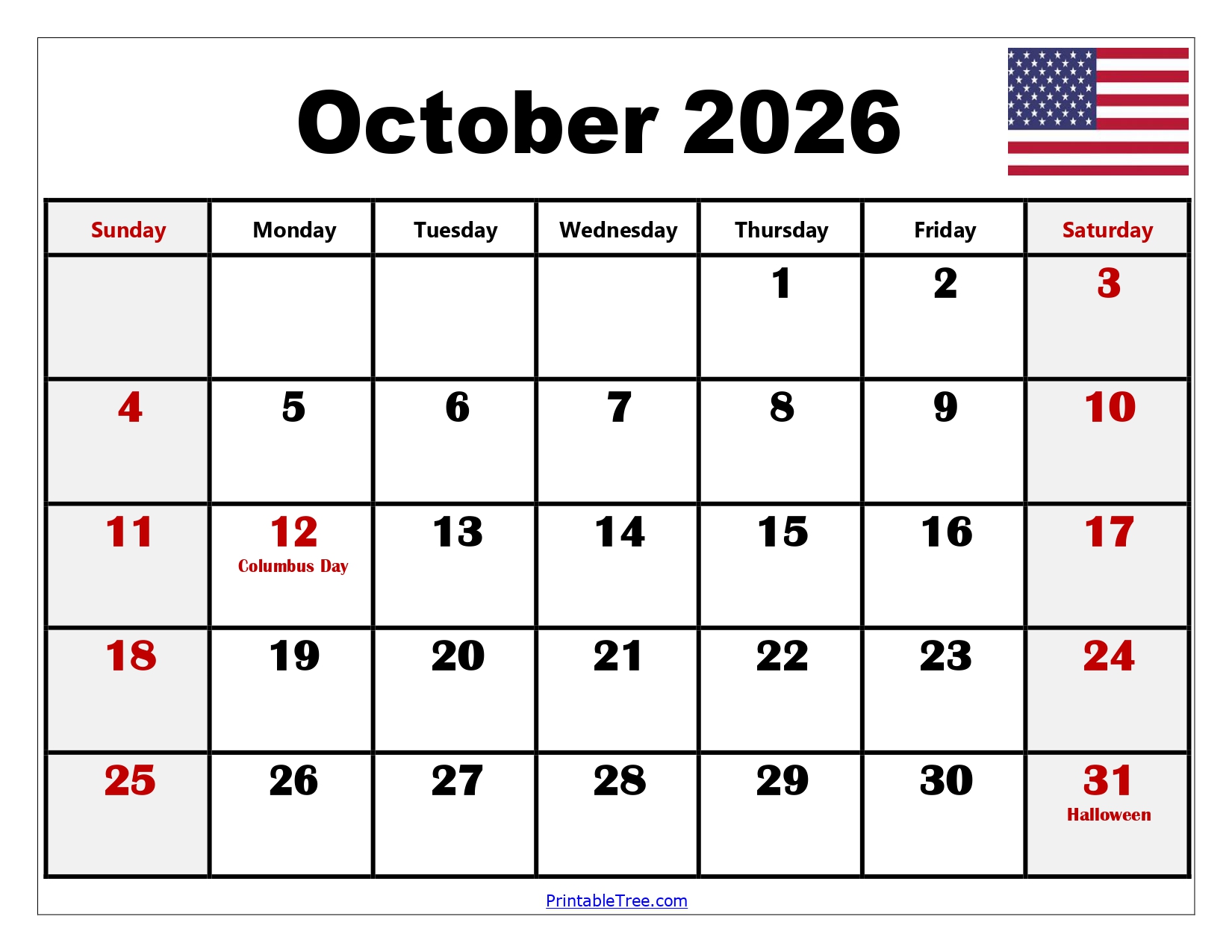

As a small business owner, every month brings its unique set of challenges and opportunities. However, October often stands out as a pivotal period. It’s the gateway to the crucial fourth quarter (Q4), marking a transition from summer sprints to year-end strategic planning and holiday preparations. Trust me, staying ahead of the curve during this time can be a game-changer for your financial health and overall success. This article is your essential guide to understanding the October 2026 Important Dates For Small Business, ensuring you’re well-prepared and proactive.

From navigating complex tax deadlines to seizing critical marketing opportunities, October demands a keen eye on the calendar. Over my years advising small businesses, I’ve seen firsthand how a little foresight in October can prevent major headaches later on. Let’s dive into what makes October 2026 Important Dates For Small Business a month you absolutely cannot afford to overlook.

Why Proactive Planning is Your Small Business Superpower in October 2026

October isn’t just another month; it’s a strategic checkpoint. For small business owners, it represents the final stretch of the fiscal year. This period is crucial for setting up a strong finish and laying the groundwork for the coming year. Proactive planning transforms potential obstacles into stepping stones for growth.

Avoiding Common Pitfalls: Penalties and Missed Opportunities

I’ve witnessed many businesses stumble due to missed deadlines. The IRS and state agencies are diligent about collecting dues. Overlooking a tax payment or a crucial filing can result in hefty penalties. These fines directly impact your bottom line. Moreover, a lack of planning can mean missing out on significant Q4 marketing opportunities. Competitors who plan ahead will capture market share. This can cost you valuable revenue during the holiday season.

The Strategic Advantage of a Well-Planned October

Imagine sailing smoothly through the busiest time of the year. This is the reality for businesses that engage in robust business planning. A well-structured October means your payroll is in order, your financial management is sound, and your team is ready. It allows you to focus on innovation and customer engagement. This kind of strategic decision-making sets you apart from the competition.

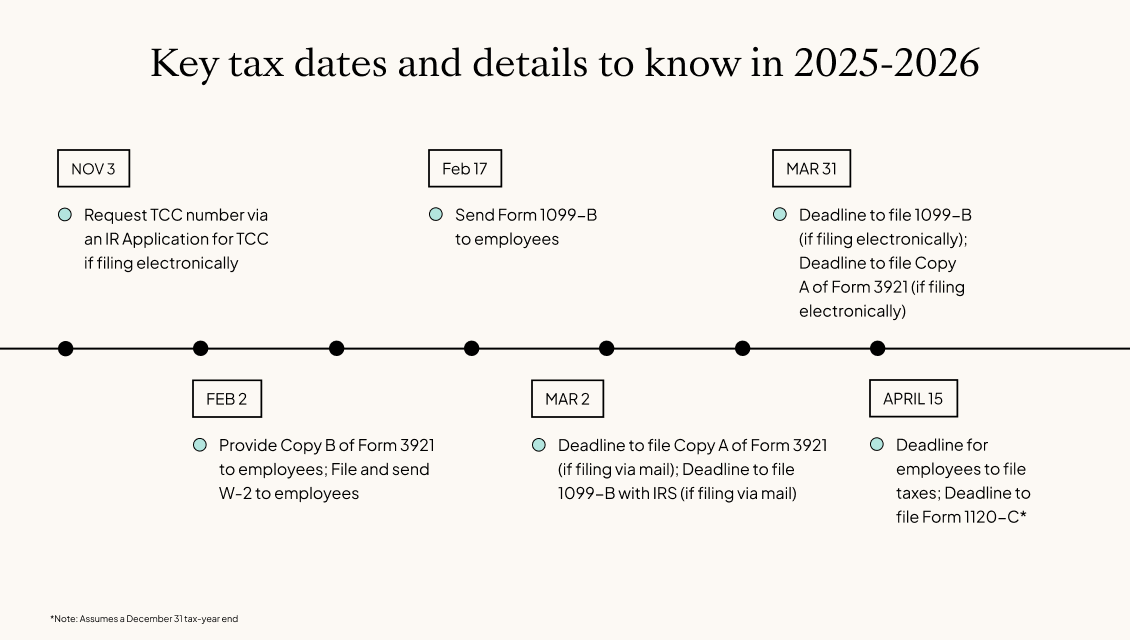

Key Financial Deadlines for Your Small Business in October 2026

October is a hotspot for various financial obligations. Keeping track of these dates is paramount for maintaining financial health. It also ensures full compliance with federal and state regulations. Let’s break down the critical ones.

Payroll Tax Filings (Form 941, State Specifics)

For most small business employers, October means attention to payroll tax filings. Specifically, the third quarter (Q3) Form 941 is due. This form reports income tax, social security, and Medicare taxes withheld from employee paychecks. Additionally, state-specific unemployment and withholding taxes often have parallel deadlines. Missing these can trigger immediate penalties from the IRS and state tax departments. My advice? Mark these dates clearly in your business calendar.

Estimated Tax Payments (Quarterly Obligations)

Many small business owners, especially sole proprietors, partners, and S-corporation shareholders, pay estimated taxes. These payments cover income and self-employment taxes. The third quarterly estimated tax payment for the 2026 tax year is due in October. This is a critical obligation for individual owners. Neglecting this can lead to underpayment penalties at year-end. Consult with your accounting firms to ensure accurate calculations.

Sales Tax Reporting and Payments

If your small business sells products or services subject to sales tax, October often brings reporting obligations. These can be monthly or quarterly, depending on your state and sales volume. Always check your specific state and local tax authority websites. Staying on top of sales tax ensures you act as a responsible collector for the government. It also avoids penalties for late remittances.

Other State and Local Tax Deadlines

Beyond federal obligations, many states have unique deadlines. These can include property taxes, gross receipts taxes, or industry-specific levies. My recommendation is to create a comprehensive list of all state and local tax deadlines applicable to your small business. A quick call to your state’s revenue department can clarify any uncertainties. It’s better to be overly prepared than caught off guard.

Here’s a snapshot of some simulated key federal financial deadlines you might face in October 2026. Remember, these are general guidelines, and your specific situation may vary. Always verify with official sources or a tax professional.

| Date | Obligation | Description | Relevant Forms |

|---|---|---|---|

| October 15, 2026 | S-Corp & Partnership Extended Filings | Deadline for calendar-year S corporations (Form 1120-S) and partnerships (Form 1065) that received a 6-month extension to file their 2025 income tax returns. | Form 1120-S, Form 1065 |

| October 31, 2026 | Federal Payroll Tax Deposit | Deposit FUTA tax for Q3 2026 if your accumulated liability exceeds $500. | Form 940 (Annual) |

| October 31, 2026 | Federal Payroll Tax Filing (Q3) | File Form 941 for Q3 2026, reporting federal income tax, social security, and Medicare taxes withheld. | Form 941 |

| October 31, 2026 | Individual Estimated Tax Payment (Q3) | Deadline for individuals (including sole proprietors, partners, and S-corporation shareholders) to make their third quarterly estimated tax payment for 2026. | Form 1040-ES |

Operational and Legal Compliance Checks for October 2026

Beyond finances, October is an opportune time for operational reviews. Ensuring your small business adheres to all legal obligations is as important as managing your money. Staying compliant protects your business from legal issues and fosters a responsible image.

Business License and Permit Renewals

Many business licenses and permits operate on an annual cycle. October might be the month for renewal in your locality. Check with your city, county, and state agencies. Failure to renew can lead to operational disruptions and fines. This is a simple but critical business planning item often overlooked.

Employee Benefit Plan Reviews

If your small business offers employee benefits, October is an excellent time for review. Evaluate current plans for cost-effectiveness and employee satisfaction. This can include health insurance, retirement plans, or other perks. Open enrollment periods often begin in late fall. This review ensures you offer competitive benefits. It also allows for any necessary adjustments before the new year.

Workplace Safety and Health Updates

Maintaining a safe workplace is a continuous obligation. October can be a good time to review safety protocols and conduct any required training. Check for updates from OSHA or state-level safety agencies. Ensuring operational efficiency often includes robust safety measures. A safe environment protects your employees and your business.

Data Privacy and Security Compliance

Data breaches are a growing concern for businesses of all sizes. Review your data privacy policies and cybersecurity measures in October. This is especially important as you head into the busy holiday shopping season. Ensure you are compliant with relevant data protection laws. Protecting customer data builds trust. It also safeguards your business from costly security incidents.

Strategic Business Growth Opportunities in October 2026

While compliance is vital, October is also ripe with opportunities for growth. It’s the perfect time to pivot from reaction to proactive strategy. This period sets the tone for your year-end performance and future trajectory.

Q4 Marketing and Holiday Season Preparation

The holiday season planning starts now. October is crunch time for Q4 marketing strategies. Plan your promotions, sales events, and advertising campaigns. Many businesses make a significant portion of their annual revenue during this period. Get your marketing campaigns ready to launch. This will ensure you capture the attention of eager holiday shoppers.

Year-End Budgeting and Financial Forecasting

Use October to review your budget and financial performance for the year. This allows for adjustments to financial forecasting. Identify areas where you can cut costs or increase investment. Sound budgeting is essential for business growth. It helps you allocate resources wisely for the remainder of the year and into the next.

Inventory Management and Supply Chain Optimization

For product-based businesses, inventory management is critical in Q4. Use October to assess your current stock levels. Place orders for holiday demand to avoid stockouts. Review your supply chain optimization for potential bottlenecks. Ensuring a smooth flow of goods is vital for meeting customer expectations during peak season. This directly impacts your sales and customer satisfaction.

Client Relationship Management and Outreach

October is a perfect month to reconnect with your key clients. Strengthen client relationship management efforts. Send personalized thank you notes or offer exclusive early holiday promotions. Nurturing these relationships can lead to repeat business. It also fosters valuable referrals. Showing appreciation goes a long way in customer retention.

Leveraging Technology for October 2026 Deadlines

In today’s digital age, technology is your best friend for managing important dates. It streamlines processes and reduces the risk of human error. As an entrepreneur, leveraging the right tools can save you time and stress. This ensures you never miss a beat.

Accounting Software and Payroll Systems

Modern accounting software is indispensable for small business owners. Solutions like QuickBooks, Xero, or FreshBooks automate many financial tasks. They track expenses, manage invoices, and simplify tax reporting. Integrating these with reliable payroll systems ensures accurate and timely employee payments. These tools dramatically reduce the burden of financial compliance.

Digital Calendars and Reminder Tools

Gone are the days of relying solely on paper calendars. Digital calendars (Google Calendar, Outlook Calendar) offer powerful reminder features. Set multiple alerts for each deadline. Share your business calendar with your team. This creates shared accountability. Many project management tools also have calendar integrations. This further enhances your ability to track tasks and important dates.

Document Management and Cloud Storage

Organizing your business documents is crucial for quick access during audits or reporting. Cloud storage solutions like Dropbox, Google Drive, or OneDrive offer secure storage. They also provide easy access to important files from anywhere. Implement a robust document management system. This ensures tax forms, legal documents, and financial records are always at your fingertips. It saves valuable time when preparing for tax compliance.

Expert Tips for Navigating Your October 2026 Calendar

As someone who’s guided many small business owners, I’ve gathered some insights. These tips will help you navigate the complexities of October. They will ensure you meet all your legal obligations and achieve your growth targets. Adopt these strategies to make your October smooth and successful.

Create a Centralized Business Calendar

This is my number one tip. Compile all your important dates into one master business calendar. Include tax deadlines, payroll dates, marketing campaign launches, and any permit renewals. Color-code different types of deadlines. This visual organization makes it easier to see what’s coming up. Share this calendar with key team members. It fosters a culture of shared responsibility and proactive management.

Delegate and Empower Your Team

You don’t have to do everything yourself. Delegate tasks related to various deadlines to trusted team members. Empower them with the necessary information and resources. This not only lightens your load but also builds team capability. Clear communication about responsibilities is key. This strategy enhances overall operational efficiency and ensures tasks are completed.

Seek Professional Advice (Accountants, Lawyers)

Don’t hesitate to lean on professional advice. Your accountant can help with complex tax calculations and filings. A business lawyer can advise on legal obligations and compliance matters. Investing in expert guidance can save you from costly mistakes down the line. It ensures your small business remains compliant and well-protected. They are invaluable partners in your success journey.

Build a Financial Buffer

Life as an entrepreneur is full of unexpected twists. Having a financial buffer or emergency fund is crucial. This buffer can cover unforeseen expenses or temporary cash flow dips. It provides peace of mind. It also allows you to handle unexpected issues without derailing your plans. This demonstrates good financial management and resilience.

Final Thoughts: Embracing October 2026 for Business Success

October is undeniably a busy month for small business owners. However, with the right approach, it can also be one of the most rewarding. By meticulously tracking the October 2026 Important Dates For Small Business, you’re not just avoiding penalties; you’re actively building a more resilient and prosperous enterprise. Proactive business planning allows you to transform potential stress into genuine business growth opportunities. Embrace the challenge, leverage your tools, and trust in your ability to manage these critical milestones.

By staying informed and acting decisively on the October 2026 Important Dates For Small Business, you position your company for a strong finish to the year and an even stronger start to the next. Remember, consistent effort in compliance and strategic foresight pays dividends. Here’s to a successful October for your small business!

Frequently Asked Questions

Why is October a particularly important month for small businesses?

October is crucial because it marks the start of the fourth quarter (Q4), which is often the busiest and most profitable period for many businesses due to holiday sales. It also includes key federal and state tax deadlines, such as Q3 payroll tax filings and estimated tax payments, making proactive planning essential for financial health and compliance.

What are the biggest financial risks if I miss a deadline in October 2026?

Missing deadlines in October 2026 can lead to significant financial penalties from federal and state tax authorities for late filings or payments of payroll taxes, estimated taxes, or sales taxes. These penalties can erode your profit margins and impact your cash flow, creating unnecessary financial strain on your small business.

How can I efficiently track all the important dates for my small business?

To efficiently track important dates, create a centralized digital business calendar. Integrate all tax deadlines, payroll schedules, permit renewals, and strategic planning dates. Utilize reminder tools, set multiple alerts, and consider sharing the calendar with key team members to ensure shared accountability and prevent missed obligations.

Beyond taxes, what operational aspects should I focus on in October for year-end success?

Beyond taxes, October is ideal for Q4 marketing and holiday season preparation, year-end budgeting and financial forecasting, optimizing inventory and supply chains for peak demand, and strengthening client relationships. Reviewing business licenses, employee benefits, workplace safety, and data security are also critical operational checks.